TLG Global – ESG Policy

As long-term investors, we recognize that sustainability risks, if not properly managed, may impact the performance of investments. It is part of TLG Global’s values to integrate the analysis of such sustainability risks into our investment process, whether they are environmental, social, or governance-related.

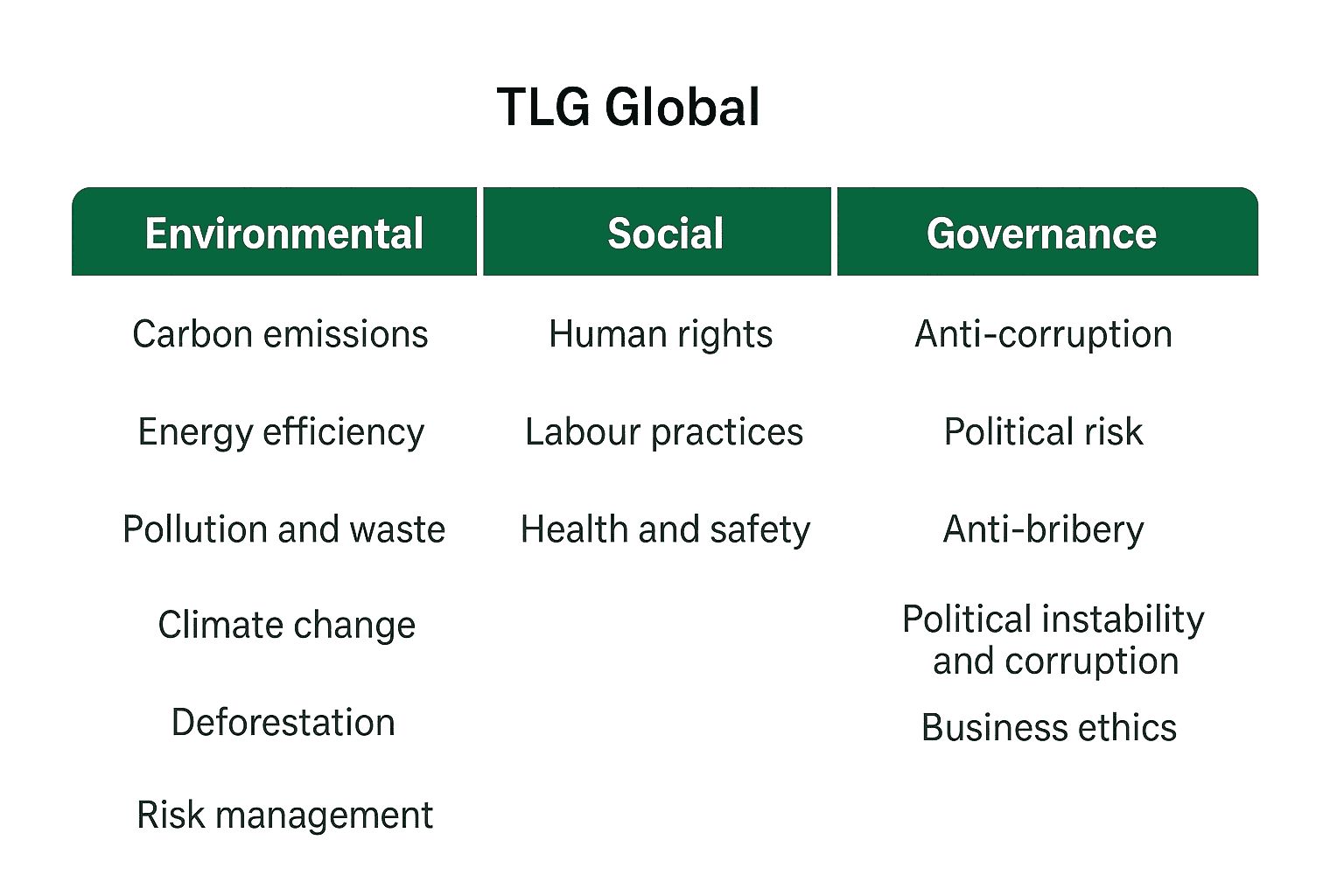

The sustainability factors that TLG Global considers are presented in the following ESG framework:

Policy

To implement our philosophy, we combine a series of responsible investment methodologies throughout our investment process. ESG screenings (norm-based screenings, sector exclusions, and “worst-in-class” filters) are applied to exclude companies from the investment universe.

ESG integration is then applied to analyses and investment decisions, adopting the definition

provided by the UN Principles for Responsible Investment—namely, “the explicit and systematic inclusion of ESG issues in investment analysis and decisions.”

This means that, in strict adherence to TLG Global’s investment process, our investment teams conduct analyses of financial and ESG information on any potential investee company or asset to identify material ESG risk factors that could exacerbate financial risks.

Once identified, our teams assess their potential impact on the company’s performance. Investment decisions will therefore include considerations of financially material ESG factors.

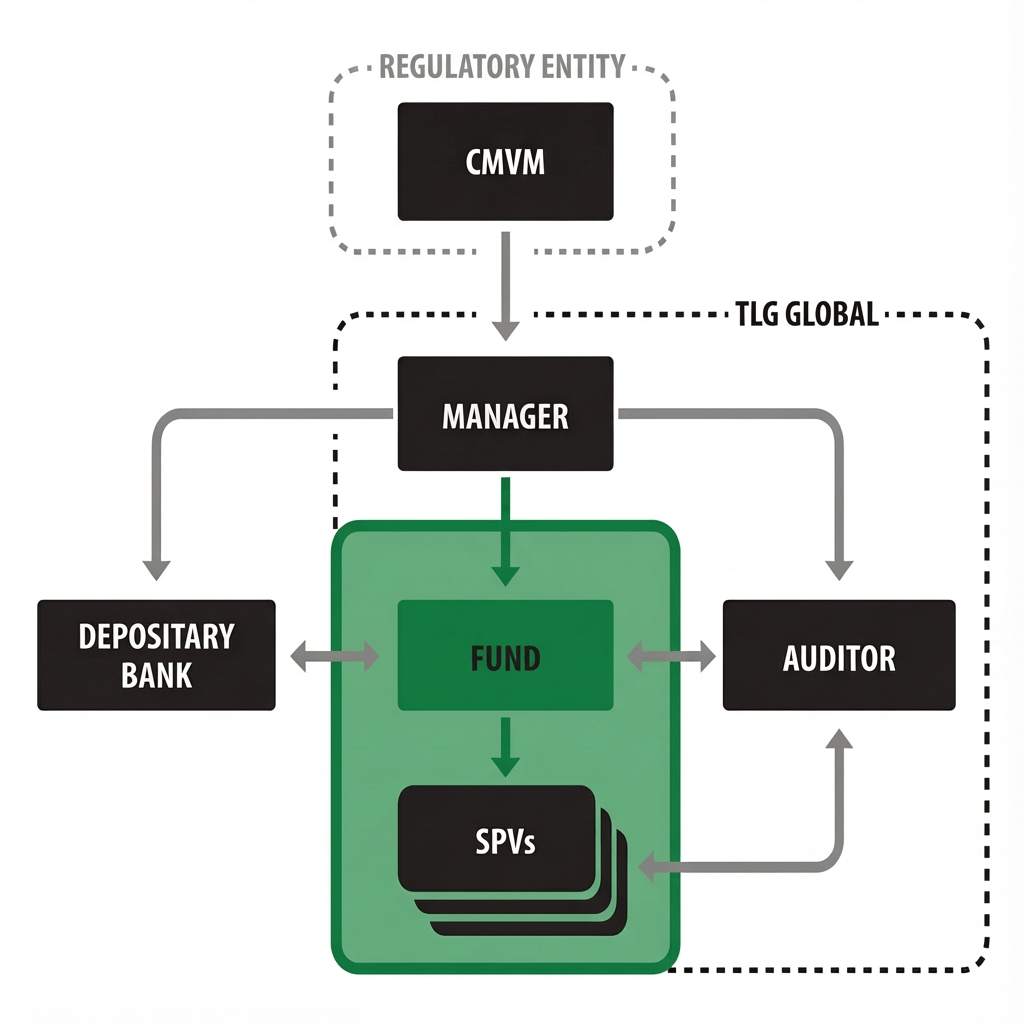

Operational Model of an Investment Fund

ESG Integration is focused between the Fund and SPVs or investments, highlighted in green.

ESG Governance and Investment Approach

People

ESG Oversight

Senior Leadership Team

The TLG Global Board and Senior Leadership Team receive regular updates on sustainability matters.

TLG Global’s Head of ESG reports directly to the CEO, Chairman, and Chief Legal Officer, ensuring high-level supervision and strategic alignment.

Sustainability Committee

A formal Sustainability Committee is responsible for supporting the implementation of the sustainability strategy across all business units and investment activities within TLG Global.

Investment Professionals / Fund Managers

TLG Global’s investment professionals and fund managers are responsible for incorporating ESG factors into the investment process, ensuring that sustainability risks and opportunities are considered at every stage of decision-making.

Process

TLG Global’s investment process aims to maximize opportunities for superior long-term returns across multiple asset classes by applying effective execution and responsible investment strategies aligned with strong ESG principles.

The fund seeks to:

Increase exposure to investments with low sustainability risks

Reduce exposure to investments with high sustainability risks

As a result, TLG Global aims to continuously improve the environmental, social, and governance profile of its investment portfolio.

Exclusions

The fund excludes companies that:

Seriously violate international norms

Conduct significant activities that cause adverse impacts on society or the environment

This ensures that capital is allocated responsibly and in alignment with TLG Global’s ethical standards.

Active Ownership

TLG Global may engage with company management teams regarding relevant ESG issues.

If progress remains unsatisfactory despite reasonable engagement efforts, the fund may choose to reduce or exit the investment.

Engagement

Although ESG engagement can take many forms—most commonly through private meetings with companies—TLG Global strives to maintain a two-way dialogue and avoids a prescriptive or punitive approach.

The objective is to support companies in improving their ESG performance while building long-term value.

Due Diligence

TLG Global’s due diligence process assesses the following key areas:

Clarity and robustness of the company’s long-term strategy

Effectiveness and caliber of governance and leadership structures

Financial strength, performance, and fair valuation of underlying assets

Sustainability risks, opportunities, and potential adverse impacts on society and/or the environment

This comprehensive review ensures informed and responsible investment decisions.

Stewardship

TLG Global practices stewardship as a means to extend the implementation of its sustainable investment philosophy.

The ultimate goal is to protect and enhance the value of the assets entrusted to the company by its investors.